In 2026, in order to be 100% deductible, company vehicles will be required to be CO2-free. But for companies and the self-employed, new rules will already apply from 1 July 2023.

Under the pressure of increasingly restrictive environmental standards, the vehicle fleet is undergoing a major change. In view of the necessary transition phase towards carbon neutrality, company vehicles are not exempt. It was in this context that the 'Van Peteghem' law was passed to green the Belgian fleet. Major changes are expected in the company car landscape, as from 1 July 2023, new conditions for tax deductibility will be applied depending on the type of vehicle and its date of purchase.

1. Tax deductibility of combustion and PHEV vehicles

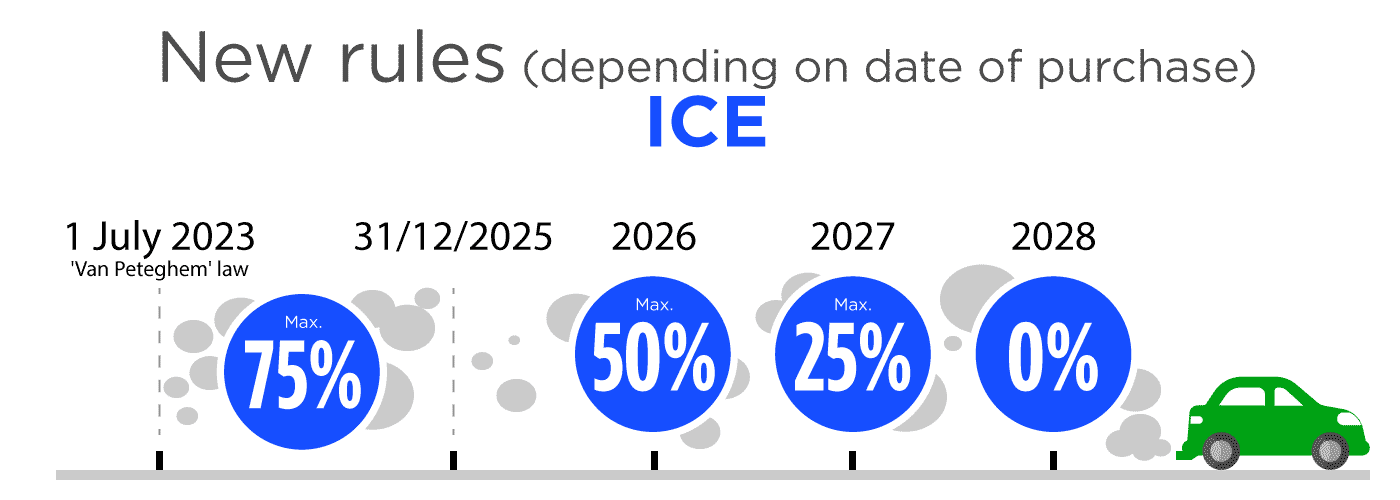

For all combustion and PHEV vehicles purchased before 1 July 2023, the current rules will continue to apply. For those acquired between 1 July and 31 December 2025, a specific measure will come into force with a degressive tax deduction of maximum 75% in 2025, 50% in 2026, 25% in 2027 and 0% in 2028. Any vehicle with a combustion engine ordered after 1 January 2026 will no longer be deductible.

As regards the deductibility of fuel costs, this will now be limited at 50% for all combustion engine vehicles and PHEVs acquired between 1 July 2023 and December 2025.

Finally, there will be no limitation on electricity costs in order to encourage the use of the electric motor on plug-in hybrids.

2. Deductibility of electric vehicles

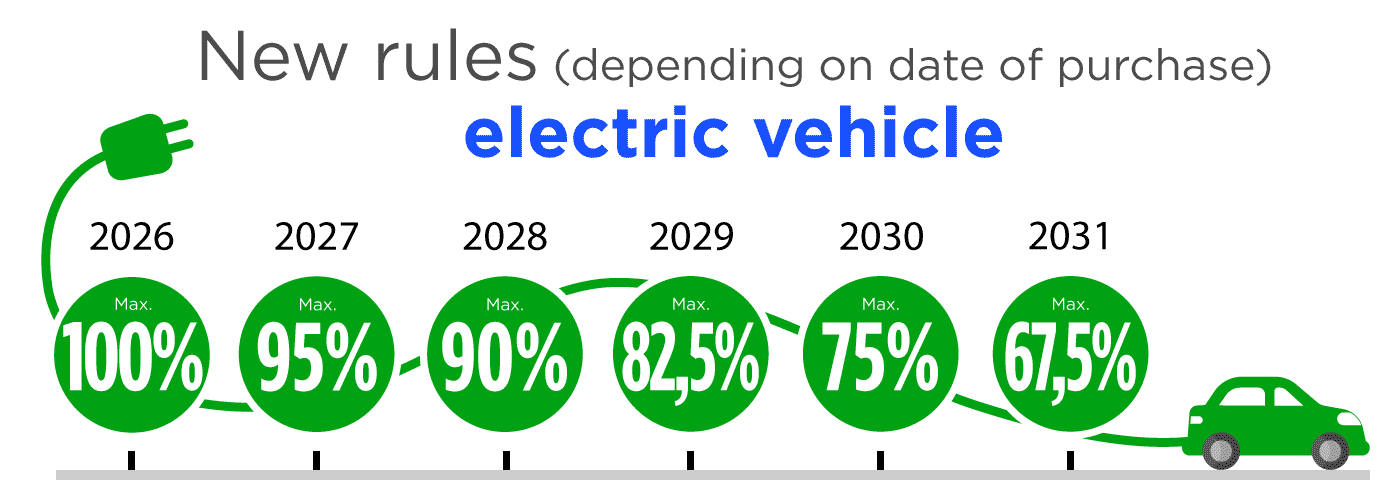

Electric vehicles ordered until the end of 2026 will be 100% deductible. From 2027 on, any electric vehicle ordered will have its deductibility reduced to the percentage corresponding to its year of order (see illustration below).

3. Increase in the carbon tax

While there are no major changes for the Flemish and Brussels regions for the moment, in Wallonia a new road tax will be effective from 1/09/2023 with a new formula influenced by the weight and CO2 emissions of the vehicle:

Old TMC amount (based on kW including malus) x (CO2/150) x (MMA/2000) x coefficient

Another new feature of the carbon tax is that from 1 July 2023, it will increase annually and progressively for all internal combustion vehicles and PHEVs, this time at national level.

4. What's new in Mercedes-Benz PHEV ?

December 2022 is full of news with the release of the new facelift for the A250e and B250e Class on 13 December.

The new C300de Class (PHEV diesel) is now available to order, as is the EQS SUV.

Let's not forget the new GLC SUV PHEV available since 24/11 and of which you can find a complete presentation video on our website.

Would you like more information on these new regulations? Are you interested in purchasing a new vehicle and would like to optimise its deductibility? Contact us, our sales team is at your disposal to answer all your questions.